Building Generational Wealth is No Accident

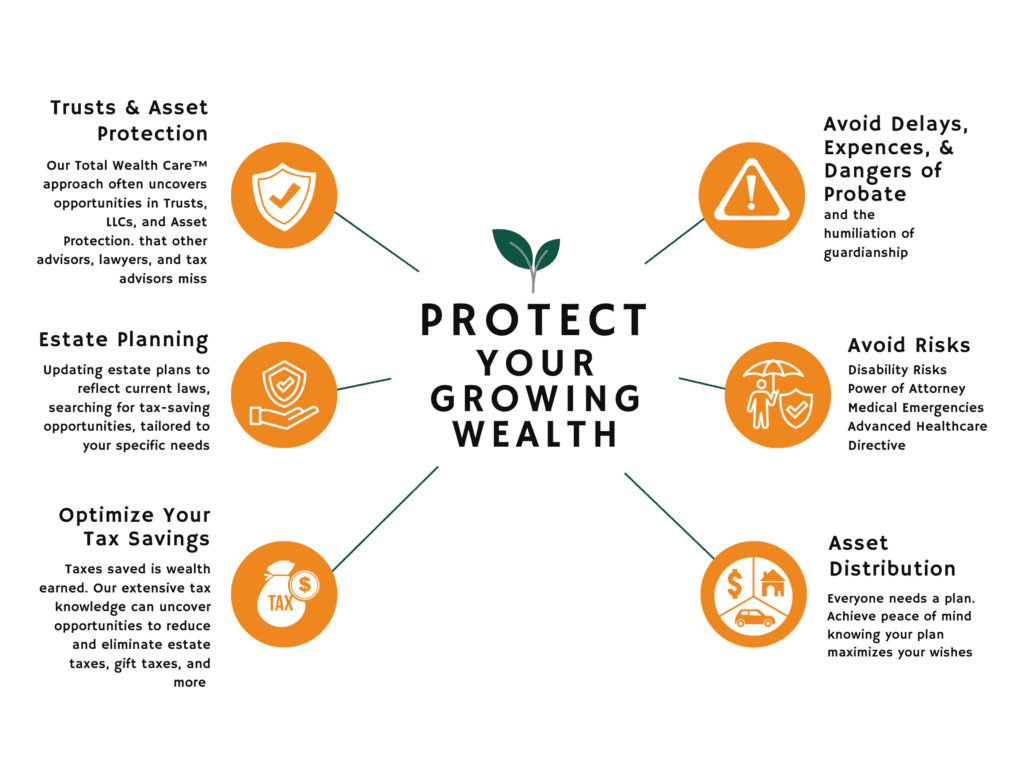

Estate planning is one of the most confusing and often-bungled areas of wealth planning. Poor planning often exposes millions of dollars in family wealth to needless taxes and other losses. Investors – even wealthy ones who’ve paid a lot to attorneys or others for expensive estate planning and legal documents – often have incomplete or defective plans.

This can guarantee expensive but avoidable probate, the public release of confidential family wealth information, and expose millions to avoidable estate taxes. It can also leave wealth needlessly exposed to lawsuits, will contests, children’s accidents or divorces, and other wealth attacks.

As you get to know Camarda, we think you’ll decide we have deep expertise to carefully map out and correct your estate planning. We have the skills to help ensure your wealth is protected and flows to your family precisely as you wish.

Estate planning is included in our standard service. And as an add-on service, if you wish, we can also provide turnkey planning, all in-house*, including legal documents custom-prepared by the lawyers on our TaxMasterTM team.

*Camarda is affiliated through common ownership and control with TaxMaster.US, LLC (“TaxMaster”), a consulting firm providing estate planning, business planning, insurance consulting, tax services, accounting, and/or other non-investment advisory services to its clients and Family Wealth Education Institute (“FWEI”), an educational company, offering wealth education content to consumers and advisors. We will share information regarding you and your relationship with us between our affiliated companies and may market products or services to you based on personal information collected or compiled by any of our affiliated entities. This information may include, among other relevant eligibility information, your income, your account history with us, insurance, tax information, estate planning or other needs revealed through financial planning, consulting or other advisory services, and/or other financial information revealed during meetings with us.

“Getting your estate right to avoid tax and protect wealth requires experience and knowledge. On the surface, the legalese can all look the same, but produce sharply different results.”

Let us help you put it all together. Avoid estate taxes for generations by using best-practices techniques. Better enjoy, control, and protect your wealth. We make it very easy to get superior estate results.